Liz Looks at: Pushing Prices Higher

One Peak Leads to Another

As higher inflation readings rolled in this week (Consumer Price Index +8.5% year-over-year, Producer Price Index +11.2% year-over-year), the temptation to call a peak in inflation is real. So what if it is the peak? Does that mean we’re out of the woods?

No. Unless it peaks and subsequently tumbles down a steep hill, we’re still facing significantly higher prices for the coming months and maybe quarters. Asking whether this is peak inflation is an incomplete question, in my opinion. The more important question is, what if peak inflation coincides with peak spending?

What we need to focus on is how rising prices have affected the mood of consumers and businesses — and ultimately, how it might affect their behavior.

Putting Our Money Where Our Mouths Are…Literally

Food is an essential spending category for all consumers, and although we can make substitutions within the category (e.g., swapping chicken out for pork), we cannot choose to stop buying it all together. No matter how you slice and dice it (pun intended), if food prices rise, costs to consumers rise.

Food-at-home inflation rose 10% in March vs. one year ago, which is higher than the headline inflation number and higher than food-away-from-home inflation of 6.9% for the same period. Protein items alone were up 13.7%, and simple cooking items like fats and oils were up 14.9%!

Given that food is essential and not discretionary, one can only assume that persistently higher prices will eventually cut into the amount consumers spend on things they can do without.

Profit or Pass?

Businesses are faced with similar conundrums. The Producer Price Index came in hotter than consumer prices, meaning the rise in input costs is even steeper than the rise in end product prices.

Which forces businesses to decide whether they will let the difference eat into their profits or pass it on to consumers. Some already have passed costs through without hurting demand, but many of the companies that have done so had strong pricing power and competitive positioning. Not all will be so lucky.

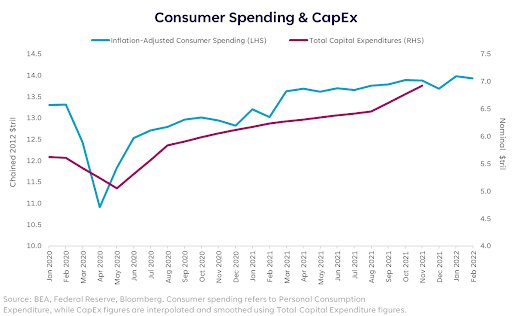

The spending decision for businesses then becomes whether they decrease Capital Expenditures (“CapEx”) in order to manage costs and limit the amount they need to pass through to consumers.

Eeny, Meeny, Miny, No

If inflation is now at levels where consumers and businesses have to make tough decisions, spending could decrease on both fronts. Meaning if this is peak inflation, it could coincide soon with peak spending. One of those is good, the other is less good.

Personal consumption and CapEx are at historical highs. No canary in the coalmine at this point. But it’s worth noting that consumer sentiment has fallen for three straight months and could indicate a looming change in consumer behavior.

We’re not conditioned for this. We spent the better part of a decade with CPI readings hovering around 2% and even falling markedly below that for periods of time. Now consumers have to choose where to spend their money. Rich prices for regular goods are making those choices more difficult.

There are many indicators we can watch to gauge the direction of our economy, but consumer behavior is at the top of my list for the next couple quarters.

Please understand that this information provided is general in nature and shouldn’t be construed as a recommendation or solicitation of any products offered by SoFi’s affiliates and subsidiaries. In addition, this information is by no means meant to provide investment or financial advice, nor is it intended to serve as the basis for any investment decision or recommendation to buy or sell any asset. Keep in mind that investing involves risk, and past performance of an asset never guarantees future results or returns. It’s important for investors to consider their specific financial needs, goals, and risk profile before making an investment decision.

The information and analysis provided through hyperlinks to third party websites, while believed to be accurate, cannot be guaranteed by SoFi. These links are provided for informational purposes and should not be viewed as an endorsement. No brands or products mentioned are affiliated with SoFi, nor do they endorse or sponsor this content.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser

SoFi isn’t recommending and is not affiliated with the brands or companies displayed. Brands displayed neither endorse or sponsor this article. Third party trademarks and service marks referenced are property of their respective owners.

Communication of SoFi Wealth LLC an SEC Registered Investment Adviser. Information about SoFi Wealth’s advisory operations, services, and fees is set forth in SoFi Wealth’s current Form ADV Part 2 (Brochure), a copy of which is available upon request and at www.adviserinfo.sec.gov. Liz Young is a Registered Representative of SoFi Securities and Investment Advisor Representative of SoFi Wealth. Her ADV 2B is available at www.sofi.com/legal/adv.

SOSS22041402

Published at Thu, 14 Apr 2022 07:00:07 -0500

Erebus Ash Gardens, Row Mx, Plot 77

Plot 77: James George Simpson (81) 16/4/1987 – Rtd Customs Officer

Dolly Simpson (93) 29/1/1997

unmarked grave

By Discover Waikumete Cemetery on 2020-11-15 14:31:20