Is Airbnb’s AirCover Property Insurance Enough Home-Sharing Coverage?

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan.

Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Renting out a home on Airbnb can be a great income source. Protecting that property is essential, though, whether you’re renting out your home when you go on vacation or have an entire portfolio of short-term rentals. And unfortunately, your regular homeowners insurance policy isn’t likely to cover home-sharing.

Airbnb offers AirCover — free liability and property damage insurance — for hosts. While this coverage can help protect you against damages or loss, it might not offer as much protection as you need.

Here’s what you need to know about Airbnb property insurance:

Homeowners insurance and home-sharing: What to know

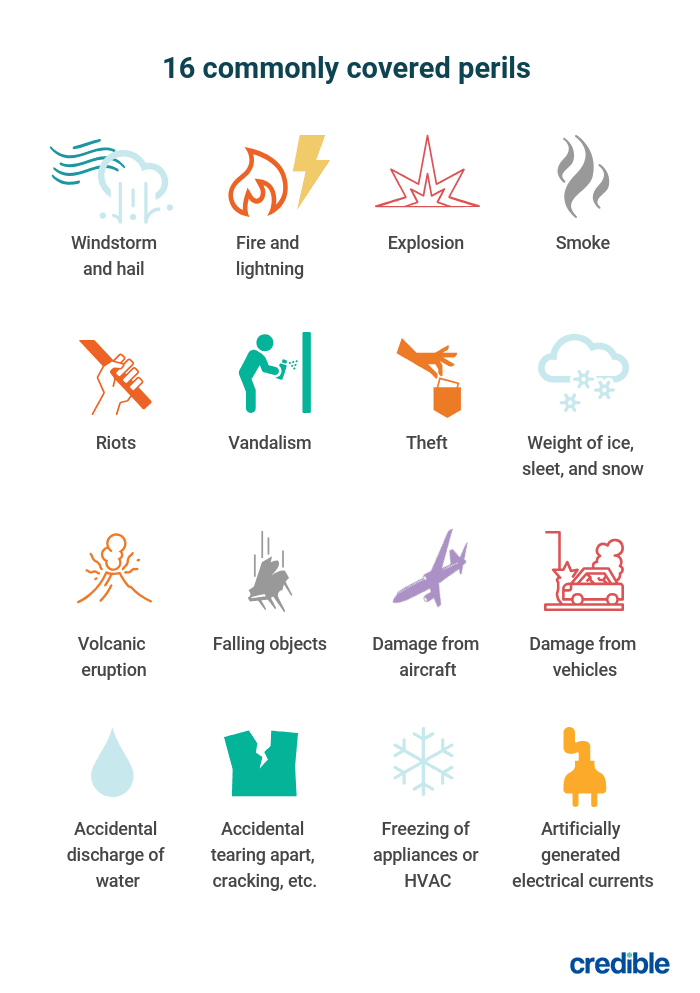

Homeowners insurance policies are designed to protect your primary residence or investment property in case of loss or damage due to covered perils. Here are some of the most common perils that homeowners insurance covers:

Homeowners insurance also offers personal liability protection, in case someone injures themselves on your property or you cause damage to someone else’s property.

But while homeowners insurance policies can be pretty straightforward, this coverage becomes a bit less clear when you start home-sharing or using your property as a short-term rental.

Airbnb property insurance, called AirCover, is offered to hosts free of charge and can provide compensation if your home is damaged or destroyed. Filing a claim through Airbnb is often complicated, though, and you may not have enough coverage to protect you financially.

If you’re thinking about listing one of your properties, it’s important to consider whether you’re adequately protected or need to buy an additional policy.

What is home-sharing insurance?

Standard homeowners insurance policies are designed for standard residences. As soon as you begin home-sharing — whether by renting out a single room to a guest on a platform like Airbnb or by renting out your entire property — your home ventures into business use territory.

If one of these guests damages your home or suffers an injury during the rental period, you might be surprised to learn that your existing policy could deny the claim.

Instead, many insurance carriers now offer home-sharing insurance coverage. This can come in the form of a supplemental rider or a separate business use policy.

Home-sharing insurance is designed to offer protection against liability, loss, and damage for a property that’s shared, whether you’re renting it out once because the Super Bowl is in town, or you’ve converted your basement into an Airbnb guest space.

What is AirCover?

Airbnb provides short-term home insurance protection to hosts while registered guests are staying on the property. This coverage, called AirCover, is free of charge for homeowners and is added to all bookings.

AirCover offers:

- $1 million of liability protection

- $1 million of damage protection

- Pet damage protection

- Income loss protection

- Deep cleaning protection

As a host, you’ll have up to 14 days to report a loss and file a claim against this coverage.

This coverage can give you added peace of mind that your home and personal belongings are protected, especially since AirCover is automatic and provided free of charge. However, this coverage alone may not be enough to sufficiently protect you.

Why might AirCover not be sufficient?

First, filing a claim with AirCover can be complicated. You’ll file a claim form online, through AirBnb’s resolution center. This form is then sent to a third party — its insurer. There, it will be assigned to an insurance representative, who will review the claim and make a determination of coverage.

The addition of an unknown insurer with whom you have no relationship can muddle things, especially when dealing with an asset as valuable and important as your home.

Second, AirCover only provides coverage for damages related to the booked stay. If a natural disaster (such as a tornado) occurs, AirCover won’t offer any protection for the property.

This could be an unexpected problem. Your standard homeowners insurance policy would typically cover that sort of loss after paying your required deductible, but if you’re using the property for business and haven’t notified your carrier or updated your policy, your claim could be at risk of denial.

Get Insurance Quotes Now

When do I need additional insurance for home-sharing?

Home-sharing insurance can offer additional protection for your property, but it isn’t always required. This is especially true if you’re not regularly using your home as a short-term rental.

For instance, you likely won’t need to purchase additional coverage when you have friends or family visiting and staying for free. As long as you aren’t accepting payment, and especially if you’ll also remain in the home, your standard home insurance policy will generally protect you.

However, if your home-sharing is part of a business transaction — where a known individual or stranger rents out your home (or some space within it) in exchange for payment — you may not be covered by your traditional homeowners insurance policy. In this situation, you may need to buy additional coverage, either in the form of a business use policy or a home-sharing rider.

Your insurer can tell you what sort of coverage you need and may offer additional policies or short-term rental insurance so you’re always fully protected. Plus, if you buy this additional coverage through an existing insurer (known as bundling), you may also save money on premiums.

What does a short-term rental insurance policy cover?

Short-term rental insurance is typically offered as an add-on to an existing policy. Also known as vacation rental insurance, this coverage is designed to offer liability and property damage protection when renting out a home on a short-term basis.

It can offer coverage against:

- Personal injury liability

- Property damage protection

- Coverage for certain amenities or equipment

- Stolen property

- Loss of use/loss of income

- Debris removal

- Bed bug treatment

How much does home-sharing insurance cost?

The cost of home-sharing insurance varies based on a number of factors. Your rate will be determined by the type of coverage you have already, the size and value of your home, location, how often you rent the property, how much protection you want to buy, and your past claims history.

With that said, you may be able to add home-sharing insurance to an existing policy for about $40 to $60 per year. You’ll want to contact your current homeowners insurance carrier to get a quote for adding this coverage, though it’s a good idea to also shop around for a new policy through different carriers.

Get Insurance Quotes Now

Home-sharing insurance FAQs

Here are the answers to some of the most commonly asked questions about home-sharing insurance.

Does renters insurance cover my Airbnb?

A renters insurance policy is designed to protect you and your belongings when you rent and live in a property that you don’t own. This coverage wouldn’t protect you if you choose to rent out a property you own to another individual.

For that, you’d need to purchase landlord, rental property, or home-sharing insurance coverage, depending on your carrier and how often you rent out your property.

Does landlord insurance cover my Airbnb?

If you’re renting out a secondary or investment property to others, you may need a landlord policy. This policy offers protection for the dwelling as well as loss of income coverage, loss of use coverage, and liability coverage. It offers more coverage on top of what you get from AirCover.

How much home-sharing insurance should I buy?

The amount of coverage you should purchase depends on a variety of factors. You should consider how much your home is worth, what you owe on the property, and how valuable the belongings are inside your home (including things like appliances and furniture).

You may also want to factor in your assets and any other coverage you may have, such as an umbrella policy. Since home-sharing insurance offers not just property protection but also liability coverage, it’s important to choose a policy with enough coverage to meet your individual needs. Consider working with an insurance agent to determine exactly how much coverage is right for you.

Disclaimer: All insurance-related services are offered through Young Alfred.

Published at Wed, 19 Oct 2022 18:30:49 -0500

WSC2022SE_Brampton_Skill01_IMG_4199

By WorldSkills on 2022-10-18 11:53:56